Mumbai: Markets ended in the red for the second straight week due to persistent selling pressure from operators and investors following uncertainty over Bihar Assembly election results coupled with disappointing quarterly earnings by blue-chips.

Persistent foreign capital outflows, sustained fall in the value of rupee against the dollar also led to fall in share values.

Investors refused to play ball as they digested US Fed Chair Janet Yellen's announcement on Wednesday that a December rate hike is very much on the table as the economy has performed well.

Shares of Healthcare, Capital Goods, Metal, Power, Realty and Banking sectors fell sharply due to heavy selling pressure.

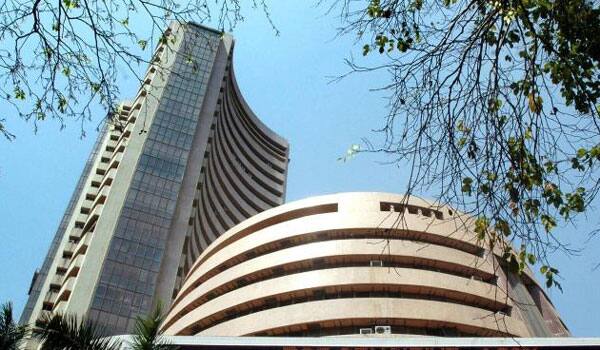

The Sensex resumed lower at 26,641.69 and hovered in a range of 26,824.30 and 26,190.18 before closing at more than 5-week low at 26,265.24, showing a loss of 391.59 points or 1.47 percent. It had last ended at 26,220.95 on October 1, 2015.

The Sensex dropped by 1,205.57 points or 4.39 percent in two weeks.

The CNX 50-share Nifty also ended lower by 111.50 points or 1.38 percent to more than 5-week low of 7,954.30. It had last ended at 7,950.90 on October 1, 2015.

It has also dropped by 341.15 points or 4.11 percent in two weeks.

"Market players remained glued to the developments in Bihar elections, which markets believe may be a catalyst to the investment mood of FPIs and FIIs in the near term," said Hiren Dhakan, Associate Fund manager, Bonanza Portfolio Ltd.

Foreign portfolio investors (FPIs) continued their selling pressure as they sold shares of net worth Rs 1,085.07 crores during the week as per the SEBI's record, including the provisional figure of November 6.

A total of 18 scrips out of the 30-share Sensex pack ended lower while 13 others closed higher.

Some of the major losers were Tata Steel, down by 10.80 percent followed by Sunpharma (9.60 percent), Vedl (7.75 percent), GAIL (6.49 percent), Bajaj Auto (5.00 percent), Cipla (4.62 percent), HDFC (4.08 percent), Hindalco (3.75 percent), among others.

However, Coal India rose by (6.80 percent) followed by M&M (6.38 percent), Tata Motors (3.07 percent), SBI (2.55 percent), NTPC (1.92 percent) and HeroMotoco (1.85 percent).

Among the S&P BSE sectoral indices, Healthcare dipped by 6.07 percent followed by Consumer Goods 3.74 percent, Metal 2.11 percent, Power 1.99 percent, Realty 1.94 percent, Bankex 1.40 percent, Consumer durables 0.89 percent and Teck 0.31 percent.

Small-cap and Mid-cap indices also dropped further by 2.32 percent and 1.35 percent respectively.

The total turnover during the week on the BSE rose to Rs 14,175.65 crores from last weekend's level of Rs 14,135.95 crores while NSE fell to Rs 75,383.95 crores from Rs 90,401.01 crores.