Zee Media Bureau

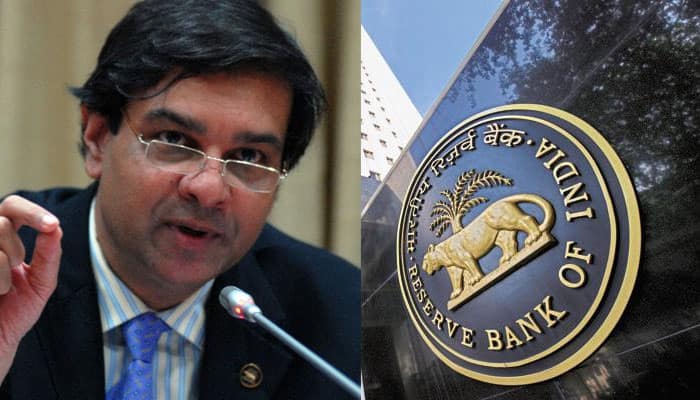

Mumbai: A month into the job, Reserve Bank of India (RBI) new Governor Urijit Patel will on Monday and Tuesday chair his maiden policy review.

This will be Patel's maiden policy announcement as the Governor. He was the deputy governor in-charge of the monetary policy function for over four years before the recent elevation.

It will also be the first policy to be announced under MPC, where the decision-making on rates will shift to the six-member panel which has equal representation from RBI and the government.

In case of a tie, Patel will have a casting vote in deciding on the interest rate as guided by a newly established inflation target. He, however, would not be able to veto a majority decision.

While RBI nominees are Executive Director Michael Patra, Deputy Governor in-charge of monetary policy R Gandhi and Patel, who has a casting vote, the government's members are Chetan Ghate of the Indian Statistical Institute, Pami Dua of Delhi School of Economics and Ravindra Dholakia of IIM Ahmedabad.

While the previous RBI Governor Rajan was often accused of keeping borrowing costs too high and hurting growth, the MPC will be guided by the inflation target set by the government last month. It has to ensure that consumer inflation stays within 2 to 6 per cent.

There are expectations that Patel will go for cut in interest rate on easing inflation. The Reserve Bank has reduced interest rate by 150 basis points since January 2015 with an aim to boost economic growth.

Close scrutiny by Markets

Regardless of the outcome, market players will closely scrutinise how the newly-formed MPC votes, trying to spot the doves and hawks among the six panel members.

The policy repo rate has stood at 6.50 percent since April. As inflation is likely to slow on the back of slumping food prices after a good monsoon, most analysts expect the benchmark rate to be cut by 25 basis points this year - which would take it to its lowest since November 2010. But the question is when.

But the RBI could opt to wait. The US Federal Reserve`s gradual approach to increasing rates has given India, and other emerging market economies, extra time in a low rate environment to support their economies.

Though the MPC has been given a mandate of "maintaining price stability," it must do so "while keeping in mind the objective of growth," according to the amended RBI Act.

India has been the fastest growing major economy, but it is still missing investment levels needed to sustain strong growth, and in the March-June quarter expansion slowed to 7.1 percent annually from 7.9 percent in the previous quarter.

A flare-up on the border with Pakistan has the potential to upset India`s markets, though most analysts believe it would have to escalate markedly to impact RBI policy.

Monetary Policy timing shifted

RBI has decided to change the timing of announcement of its policy review, due next Tuesday, to mid-afternoon.

For long, the central bank has been unveiling the monetary policy at 11 am.

The announcement, which will come in during market hours itself, will be followed by a press conference to be addressed by new Governor Urjit Patel at 2.45 pm.

Under his predecessor Raghuram Rajan, the press meet had been starting at 11.10 am followed by a conference call with researchers and analysts in afternoon.

When D Subbarao was at the helm, he addressed the press at 3 pm after announcing the policy at 11 am while the analyst call was slated for the next afternoon.

Since this is the fourth bi-monthly policy review of this fiscal and the first under the MPC framework, the Reserve Bank will be coming up with the twice-a-year Monetary Policy Report that takes stock of macroeconomic developments.

Patel makes investors keen

Investors are keen to hear Patel`s views as he has made no public appearances since becoming governor on September 4, following three years as a deputy to his predecessor, Raghuram Rajan.

Patel is regarded as less likely to stir controversy than Rajan. The former International Monetary Fund chief economist had irked some members of India`s Hindu nationalist government with his socio-economic commentaries before quitting after just one three-year term.

Investors say they will seek clues to how Patel plans to steer the rupee through some pressure over coming months due to expected outflows of $25 billion as dollar deposits raised during a rupee crisis three years ago are due to mature.

Patel, a former executive at energy conglomerate Reliance Industries, will also be scrutinised to see how he follows through on a campaign to make banks clean up their balance sheets. Some bankers have complained that Rajan`s March 2017 deadline was pushing them too fast.