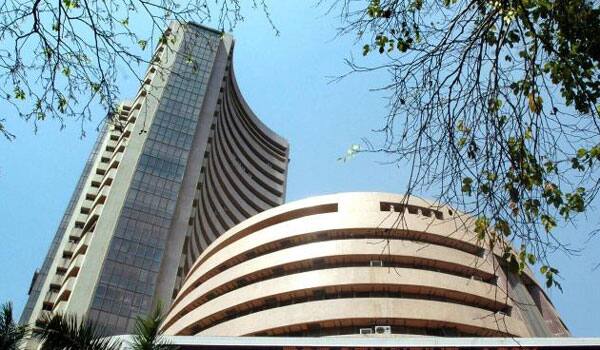

Mumbai: The China factor, for a change, gave markets some cheer Tuesday as a late surge in Chinese equities propelled the benchmark BSE Sensex by 424 points, which signed off above the psychological 25,000-level.

The rub-off effect was visible on the NSE Nifty, which too picked up.

The meeting of the Prime Minister Narendra Modi with industry captains, bankers and economists to discuss ways and means to support the economy amid a global slowdown gave investors a lot to chew on, which in turn boosted sentiment.

Also Read- Rupee bounces back by 27 paise to close at 66.55 against USD

"The government's meeting with corporate leaders acknowledging global concerns that are impacting India has calmed the market," Vinod Nair, Head-Fundamental Research at Geojit BNP Paribas Financial Services.

Financial stocks took the centre-stage as speculation whirred around the possibility of the Reserve Bank going for a dilution of its proposed rules on base rates.

The rupee, at 66.54, looked a lot better as it shaped up from its previous two-year low, which improved the overall mood.

Tracking a firming global market, the 30-share barometer bounced back in afternoon deals and surged to day's high of 25,411 before ending at 25,317.87, a solid gain of 424.06 points, or 1.70 percent.

The gauge had lost 870.97 points in the past two sessions in large measure due to worries on China and rains deficit.

The 50-issue NSE Nifty reclaimed the 7,700-mark for a while before it finally settled higher by 129.45 points, or 1.71 percent, at 7,688.25.

GAIL added the most, up 6.48 percent, followed by Tata Steel, BHEL and Axis Bank.

The banking index was the toast of town as it jumped a neat 3.61 percent even as power, capital goods, realty and metal rallied too.

The BSE mid-cap index recovered 1.02 percent and the small-cap 0.60 percent.

China's Shanghai Composite, which had been on a sticky wicket of late, ended 2.92 percent higher while Hong Kong's Hang Seng surged 3.28 percent. However, Japan's Nikkei shed 2.43 percent.

European shares traded in the green in their early hours.

Chinese stocks edged higher in a volatile trade after Beijing introduced fresh measures -- income tax cuts and a proposed circuit breaker - to discourage short-term speculation and stem a further slide in share prices.

European shares surged after the latest data showed German exports and imports rose to their highest level in July. Premier indices in France, Germany and the UK rose up to to 2.04 percent.

As many as 26 out of the 30-share Sensex pack scooped up gains.

"The market will continue to be cautious and is likely to stabilise following the Fed rate decision next week," added Nair.

Veracity Group CEO Pramit Brahmbhatt said: "Price-sensitive stocks and blue-chips gained on value-buying and short-covering... Still investors showed some concern over the decline in Chinese imports."

The market breadth turned positive after 1,459 stocks gained, 1,190 stocks lost while 127 remained flat. The total turnover rose to nearly Rs 2,666 crore, from Rs 2,042.20 crore on Monday.