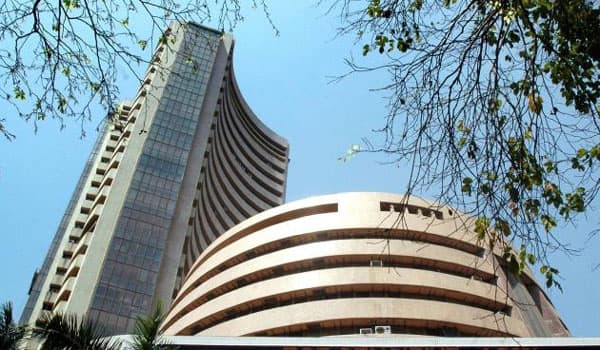

Mumbai: In a range-bound session, benchmark BSE Sensex ended higher by 19 points at 28,372.23, snapping its two-day losing spell, on fag-end buying in banking, auto and consumer durables amid positive European cues.

The 30-share index resumed lower at 28,345.49 and dropped further to 28,259.38 due to initial heavy selling pressure as wholesale inflation soared to a two-year high of 3.74 percent in August.

Industrial output contracted by 2.4 percent in July, reflecting the worst performance in 8 months mainly due to declining output in manufacturing and capital goods sectors.

However, the consumer inflation eased to a five-month low of 5.05 percent in August, mainly because of a slower rate of price increase in vegetables as well as food and beverages.

However, the Sensex recovered to 28,416.41 before ending at 28,372.23, showing a gain of 18.69 points or 0.07 percent.

The gauge had fallen by 691.74 points in the previous two sessions.

The 50-share Nifty too settled 11 points or 0.13 percent higher at 8,726.60 after moving between 8,739.85 and 8,688.90.

Of the 30-share pack, 17 closed with gains, while 13 ended in negative terrain.

Brokers said renewed expectations that RBI may announce a cut in its rate at its meeting next month, after retail inflation fell to a five-month low, triggered buying in banking and a few other stocks.

Among banking scrips, state-run SBI gained the most by rising 1.94 percent to Rs 257.60, Axis Bank climbed 1.71 percent to Rs 602.30 and ICICI Bank rose 1.06 percent to Rs 271.60.

Other gainers in the Sensex kitty included, Adani Ports, Tata Motors, NTPC, Hero MotoCorp, Cipla, Dr Reddy's, Asian Paints, GAIL, L&T, Bajaj Auto, Maruti Suzuki and Bharti Airtel, rising by up to 2.93 percent.

Coal India suffered the most by diving 1.72 percent to Rs 325 after the company reported a 14.7 percent decline in consolidated net profit for the quarter ended June 30.

Sector-wise, consumer durables gained the most by rising 1.12 percent, followed by infra with a rise of 0.99 percent, banking 0.77 percent, PSU 0.60 percent, auto 0.57 percent and power 0.55 percent.

Broader markets too were in a better shape as investors made selective buying, with the BSE mid-cap rising 1.34 percent while small-cap index gained 1.21 percent.

Meanwhile, Foreign portfolio investors sold shares worth net Rs 593.61 crore on Monday, as per provisional data.

Stock Exchanges were closed yesterday on account of 'Id-ul-Zuha'.

In regional markets, Japanese stocks led decline by diving 0.69 percent. Key indices in China, Hong Kong and Singapore dropped by up to 0.68 percent.

European markets were, however, higher in their early deals as the key indexes in France, Germany and the UK were up in the range of 0.02 percent to 0.27 percent.