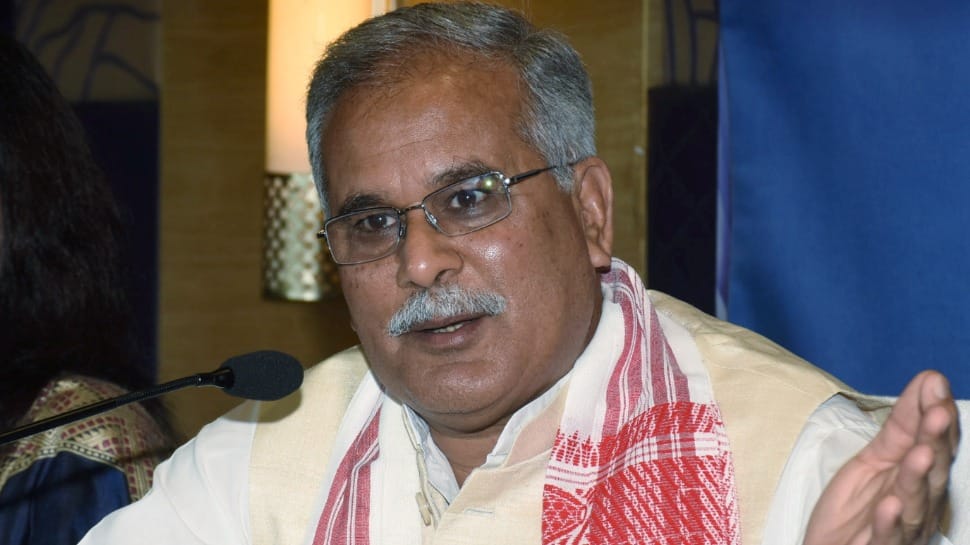

New Delhi: Chhattisgarh Chief Minister Bhupesh Baghel on Sunday (March 27, 2022) said that he has written a letter to the CMs of 17 states and has sought their support in a bid to convince the Centre to extend the period of compensation mechanism under the Goods and Services Tax (GST) for ten years beyond June 2022.

The Congress leader wrote in this connection to the CMs of Maharashtra, Jharkhand, Rajasthan, Punjab, West Bengal, Odisha, Andhra Pradesh, Telangana, Tamil Nadu, Kerala, AAP-governed Delhi, BJP ruled states - Madhya Pradesh, Uttar Pradesh, Gujarat, Karnataka and Haryana - as well as Bihar, where the saffron party is a ruling alliance partner.

"The Central Government has decided that the compensation of GST given to the states will be stopped after June 2022. This will result in a huge loss of revenue to the producing states. We had requested the Center to continue with the GST compensation or make an alternate arrangement.

"I have written a letter to the Chief Ministers of 17 states requesting that a common request should be made to the Central Government to continue the compensation for ten years," the Congress leader tweeted.

केंद्र सरकार ने निर्णय लिया है कि जून, 2022 के बाद राज्यों को दी जाने वाली जीएसटी की क्षतिपूर्ति बंद कर दी जाएगी।

इससे उत्पादक राज्यों को राजस्व की भारी हानि होगी। हमने केंद्र से जीएसटी क्षतिपूर्ति जारी रखने या वैकल्पिक व्यवस्था बनाने का आग्रह किया था।

1/2

— Bhupesh Baghel (@bhupeshbaghel) March 27, 2022

मैंने 17 राज्यों के मुख्यमंत्रियों को पत्र लिखकर अनुरोध किया है कि केंद्र सरकार से क्षतिपूर्ति दस वर्ष तक जारी रखने के लिए साझा आग्रह किया जाए।

2/2

— Bhupesh Baghel (@bhupeshbaghel) March 27, 2022

"Being manufacturing states, our contribution to the growth of the country's economy is much higher than those states which have benefited from the GST regime due to higher consumption of goods and services," he said.

If the GST compensation is not continued beyond June 2022, then Chhattisgarh is expected to face a revenue loss of approximately Rs 5,000 crore in the upcoming financial year, he claimed.

"Similarly, your state would also have reduced revenue receipts in the next financial year. It would become very difficult to arrange for a shortfall in funds for public welfare and development works," the CM told his counterparts.

Baghel further said that after the introduction of the GST regime, the autonomy of states on tax policy has significantly reduced.

"Therefore, to recover from the adverse impact of COVID-l9 on the economy and till the time actual benefits of the GST regime are realised, states with similar interests should jointly request the Union government to continue the current mechanism of compensation for at least next five years, or devise an alternate temporary mechanism to compensate for the shortfall in revenue," he added.

(With agency inputs)