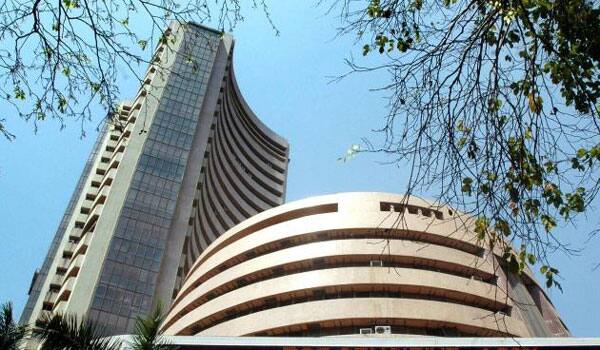

Mumbai: Benchmark Sensex ended in the green at 30,464 in see-saw trade Friday as FMCG counters buzzed following finalisation of GST rates for bulk of the items.

However, global volatility arising out of political developments in the US and emerging markets like Brazil held back the gains, brokers said.

The BSE Sensex resumed higher and hit its all-time high of 30,712.35 (intra-day), the fourth in five sessions, but later eased to a low of 30,338.52 before settling 30.13 points, or 0.10 percent higher at 30,464.92.

The broader 50-share NSE Nifty touched a high of 9,505.75 at the outset, but succumbed to profit-booking and settled 1.55 points, or 0.02 percent, down at 9,427.90.

Both the indices recorded their second straight weekly gains by rising 276.77 points, or 0.91 percent, and 27 points, or 0.28 percent, respectively.

FMCG stocks hogged the limelight after the GST Council fixed rates for most of the items. Common use products such as hair oil, soaps and toothpaste will cost less from July 1 when GST is due to set in.

"The market traded between gains and losses due to concern over US political chaos and sharp fall in Brazil which is a key part of EMs.

"Some confusion was seen in the market regarding the likely GST rate, especially for consumer discretionary... But later it was understood that the broad effective rate will be neutral to the economy while consumer staples and FMCG will see some benefits," said Vinod Nair, Head of Research, Geojit Financial Services.

Meanwhile, foreign portfolio investors (FPIs) sold shares worth a net Rs 360.59 crore, while domestic institutional investors (DIIs) bought shares worth a net Rs 897.96 crore yesterday, as per provisional data released by the stock exchanges.

In the Asian region, Japan's Nikkei rose 0.19 percent, Hong Kong's Hang Seng gained 0.15 percent, while Shanghai Composite Index inched up 0.02 percent.

In the Eurozone, Paris CAC was up 0.78 percent, while Frankfurt's DAX 40 rose 0.42 percent in early deals. London's FTSE rose 0.52 percent.

Back home, SBI shares gained 1.72 percent after the net profit of the country's largest lender more than doubled to Rs 2,814.82 crore for the March quarter.

In the FMCG space, Colgate Palmolive topped the gainers list by surging 3.59 percent, followed by Tata Coffee (3.07 percent), Jayshree Tea (3.04 percent), ITC Ltd (2.82 percent), Emami (2.46 percent), Heritage Food (2.14 percent), HUL (2.04 percent), KRBL (1.31 percent), Dabur (1.12 percent) and Marico (1.32 percent).

In the 30-share Sensex, 16 ended in green while 14 closed with losses.

Major gainers in the Sensex pack were ITC 2.82 percent, HUL 2.04 percent, Axis Bank 1.83 percent, SBI 1.72 percent, Tata Motors 1.08 percent, Cipla 0.86 percent, Lupin 0.77 percent, NTPC 0.60 percent, Tata Steel 0.53 percent, Bharti Airtel 0.47 percent and Adani Ports 0.36 percent.

However, Asian Paints fell 2.43 percent, Gail India 1.48 percent, M&M 1.35 percent, HDFC 1.16 percent, TCS 1.08 percent, Power Grid 1.06 percent, Hero Motoco 0.96 percent and Dr Reddy's 0.83 percent.

Among the BSE sectoral indices, FMCG rose 1.86 percent, Bankex 0.39 percent and Telecom 0.28 percent while Consumer Durable fell 1.04 percent, Oil&Gas 0.80 percent, IT 0.70 percent, Energy 0.65 percent, Auto 0.59 percent and Teck 0.56 percent.

The S&P BSE mid-cap index fell 0.72 percent while the small-cap index declined 0.88 percent.

The market breadth continued to remain negative as 1,789 stocks closed lower, 957 finished higher while 165 ruled steady.

The total turnover on BSE fell to Rs 4,134.78 crore from Rs 4,311.27 crore registered during the previous trading session.