New Tax Rules From April 1: Did You Know About Basic Exemption Limit? Check Here

As we all know the new tax regime is coming to effect from April 1, 2024. What are the changes going to take place under the new regime? Find out here.

Mar 30, 2024, 08:21 AM ISTExplained: How Much Cash You Can Keep At Home, What Are The Income Tax Rules In This Regard?

According to the Income Tax Act, there's no specific restriction on the amount of money stored at home. However, during an income tax raid, it becomes crucial for an individual to substantiate the source of the money.

Dec 16, 2023, 09:53 AM IST9 Years Of Narendra Modi's Government: Major Changes In Income Tax Rules

Here are some significant adjustments to the income tax laws made during PM Narendra Modi's nine-year tenure.

May 30, 2023, 23:44 PM IST

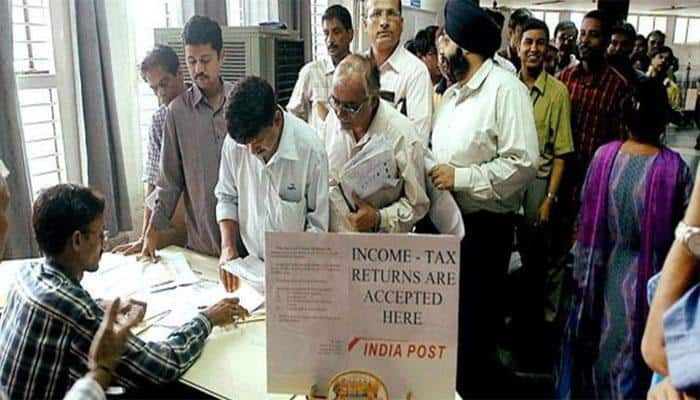

Government seeks comments on amendment of no tax deduction certificate

The tax department proposes to make changes in Form No 13 and related rules under the Income Tax Act.

Aug 21, 2018, 17:30 PM ISTNew ITR rule: Now Transgenders to be recognised as independent gender category in PAN form

Till now, only male and female gender categories were available to be chosen on the PAN application form.

Apr 11, 2018, 11:43 AM ISTFiling income tax on mutual fund investments? Note these 10 things

With the financial year coming to a close in a few short months, many might rush to hand in their investments.

Dec 09, 2017, 17:16 PM ISTBanks, MFs should obtain identification nos for filing SFT

The Income Tax department on Friday said banks, mutual funds and financial institutions should obtain an identification number and file the statement of financial transaction (SFT) by May 31.

May 26, 2017, 16:22 PM ISTChange in rules: From income tax, savings a/cs, insurance to non-BS IV vehicles; here's the impact

Several important rules and regulations will change or take effect from Saturday, as April 1 marks the start of the financial year 2017-18. The rules range from regulations on personal income tax to sale and registration of non-BS IV vehicles.

Apr 01, 2017, 10:22 AM ISTNew rules from today: From income tax, savings a/cs, insurance to non-BS IV vehicles; check out the impact

Several important rules and regulations will change or take effect from Saturday, as April 1 marks the start of the financial year 2017-18.

Mar 31, 2017, 21:42 PM ISTBusinessmen, traders required to report cash receipt over Rs 2 lakh in single transaction: CBDT

Businesses and traders are required to report any single transaction of cash exceeding Rs 2 lakh for sale of goods and services to the income tax department.

Dec 23, 2016, 15:37 PM ISTGovt notifies changes in I-T rules to comply with FATCA pact

The Revenue Department has amended income tax rules to provide for reporting of information with regards to financial assets and accounts, a month after India signed a tax information sharing agreement with the US.

Aug 09, 2015, 11:49 AM IST