From Tax On Buy Back Of Shares To Latest TDS Rates -- Here Are 6 Income Tax Rules Effective From October 1

Here Are 6 Income Tax Rules That Will Be Effective From October 1

Sep 27, 2024, 11:04 AM ISTIncome Tax Audit Report Deadline Ends On Sept 30 For FY 2023-24; Check Penalty And Steps to Submit On E-Filing ITR Portal

Income Tax Audit Report Deadline: A tax Audit is an examination or review of accounts of any business or profession carried out by taxpayers from an income tax viewpoint. It makes the process of income computation for filing of return of income easier.

Sep 24, 2024, 14:18 PM ISTCBDT Notifies New Rule For Taxpayers Effective From 1 October 2024 -- Here's All You Want To Know About Direct Tax Vivad Se Vishwas Scheme, 2024

The Central Board of Direct Taxes (CBDT) has notifies Rules and Forms for Direct Tax Vivad Se Vishwas (DTVSV) Scheme, 2024, that provides for lesser settlement amounts for a ‘new appellant’ in comparison to an ‘old appellant’.

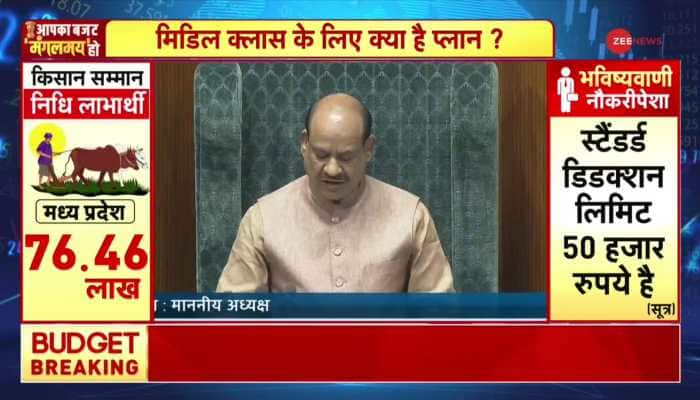

Sep 23, 2024, 10:56 AM IST100 Days Of Modi 3.0: ITR Exemption Limit To Rs 7L, Hike In Standard Deduction And More --Check Big Govt Decisions

In the first 100 days of Modi 3.0, the government has also revised rank-wise pensions under the One Rank One Pension (OROP) scheme for retirees from the Army, Navy, Air Force and other defence units, as well as for family pensioners, effective July 1, 2024.

Sep 16, 2024, 13:05 PM ISTITR Processing Time: Why Is Your ITR Still Under Processing In 2024? Here's How To Track Its Status

ITR Processing Time: Over 7 crore Income Tax Returns (ITRs) were filed by the July 31, 2024, deadline. By August 23, the Income Tax Department had processed 5.34 crore of these returns.

Aug 26, 2024, 14:07 PM ISTIncome Tax Clearance Certificate Mandatory For All Indians? CBDT Clarifies New Rule

The total number of ITRs filed for the Assessment Year (AY) 2024-25 exceeded 7.28 crore, marking a 7.5% increase compared to the 6.77 crore ITRs filed by the same date for AY 2023-24.

Aug 20, 2024, 22:43 PM ISTNet Direct Tax Collection Grows 22 Per Cent To Rs 6.93 Lakh Crore

Securities Transaction Tax (STT) mopped up Rs 21,599 crore, while other taxes (which include equalisation levy and gift tax) earned Rs 1,617 crore.

Aug 12, 2024, 20:56 PM ISTIncome Tax Refund Delay: How Long Will It Take to Get Your Refund And Will You Receive Interest?

The Income Tax department takes four to five weeks for the refund to be credited to the account of the taxpayer, according to the official website.

Aug 12, 2024, 14:20 PM ISTIndia Is Not The Country With Highest Income Tax; Check Top 7 Nations And Their Rank

Income tax rates have been a subject of debate in India. Even in the recent budget, when the Finance Minister did not announce a relief for the taxpayers, the middle class was most disappointed. But do you know that while many countries have either no or very low tax rates, income tax in some countries is as high as 59%, which is almost double compared to India's top slab of 30%?

Aug 05, 2024, 08:57 AM ISTChoosing Between Old And New Income Tax Regimes? 5 Things To Consider

Here are 5 things to consider if you are stuck between the dilemma of chosing between new and old tax regime.

Aug 01, 2024, 16:43 PM ISTNo Income Tax! Find Out Why Residents Of THIS State Enjoy Complete Tax Exemption

The Sikkim Income Tax exemption is explained in Section 10(26AAA) of the Income Tax Act.

Jul 31, 2024, 20:49 PM ISTITR Filing: Pay Zero Tax On Rs 10 Lakh Yearly Income --Here's The Math

An individual's salary is taxed as per his/her income tax structure and pay bracket. However, if you judiciously use the savings instrument prescribed in the Income Tax laws, you can save a huge amount on your taxes. Here's how.

Jul 30, 2024, 15:13 PM ISTITR Penalty Alert: What Happens If You Miss July 31 ITR Deadline Date For FY 2023-24?

Individual taxpayers not requiring audits must file ITRs for FY 2023-24 by July 31, 2024, to avoid penalties. Belated returns can be filed by December 31, 2024.

Jul 28, 2024, 18:39 PM ISTGoing Abroad? Do You Need Income Tax clearance Certificate– Govt Clarifies

According to Section 230 of the Income-tax Act, 1961, not everyone needs to get a tax clearance certificate.

Jul 28, 2024, 16:49 PM ISTITR Filing 2024: How To Check Tax Refund Status Online With PAN Card | Refund Timeline Explained

Over 5 crore taxpayers have filed their income tax returns (ITRs) for the Assessment Year 2024-25, according to an update shared by the Income Tax Department on July 27.

Jul 28, 2024, 15:02 PM ISTDon't Want To Pay Income Tax? Shift To These Places And Forget Your Tax Worries

Income tax is a tax imposed by governments on the income earned by individuals and businesses. It is based on a person's or entity's earnings, including wages, salaries, profits, and investments. But did you know that there are some countries around the world where you don’t have to pay any income tax?

Jul 27, 2024, 18:51 PM IST

Attention Salaried Taxpayers: Want To Save 100 Percent On Your Income Tax? Watch Tips Shared In Viral Video

Content creator Shrinidhi Hande, an analyst and travel blogger from Udupi, Karnataka, posted the satirical video "how to save income tax" on Instagram following the Union Budget presentation on July 23.

Jul 27, 2024, 15:29 PM ISTCash Deposit Limit: How Much Money Can You Deposit In Savings Account In A Year?

From Cash Deposit, FD to Credit Card Payments and more, know how much money can you deposit in a year.

Jul 26, 2024, 07:02 AM ISTNew Simplified Income Tax Law To Be Put Out For Stakeholder Consultation Soon

The Revenue Secretary further stated that the efforts of the government will continue to provide a hassle-free, simple, and collaborative approach towards the implementation of taxes.

Jul 25, 2024, 19:02 PM ISTGovernment to contribute major amount for Education Loan in Budget

Union Budget 2024 Update: Nirmala Sitharaman Speech- Finance Minister Nirmala Sitharaman is presenting her 7th consecutive budget.

Jul 23, 2024, 19:48 PM IST