Missed filing ITR? Don't worry, here are the options

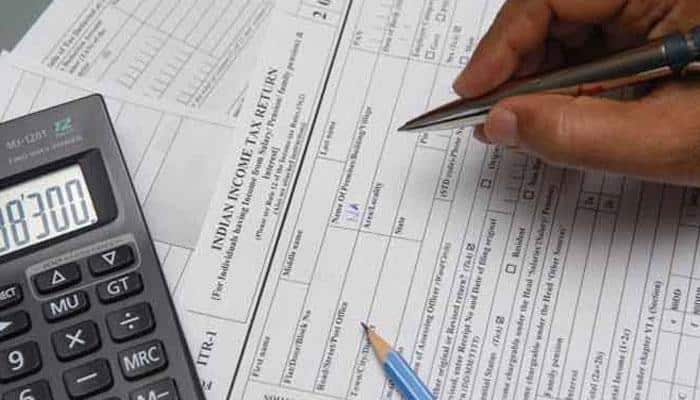

This year, taxpayers are required to submit the returns for the 2018-19 financial year and the assessment year would be 2019-20.

Sep 02, 2019, 15:39 PM ISTe-filing of ITRs reach high record, over 49 lakh ITRs filed in a single day

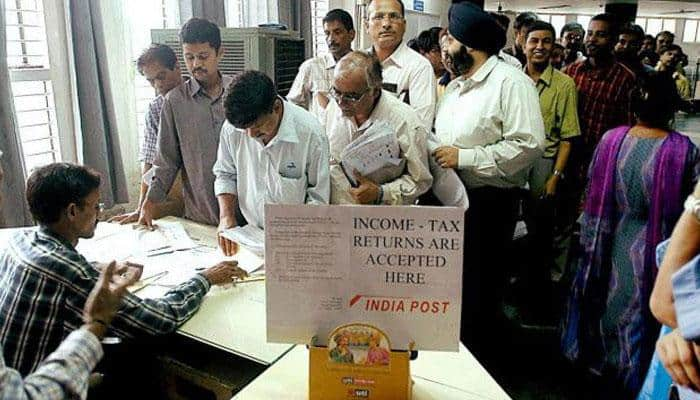

The Income Tax department has made a quantum jump in the e-filing of Income–Tax Returns (ITRs) with an all time high record of tax filing in a single day.

Sep 02, 2019, 15:19 PM ISTDeadline for filing ITR FY 2018-19 nears: Here's what you need to do

This year, taxpayers are required to submit the returns for the 2018-19 financial year and the assessment year would be 2019-20.

Aug 27, 2019, 11:27 AM ISTFile revised Income Tax Return online for manually filed return – Know who needs to file revised ITR

Revised return can be filed online under Section 139(5) of the Income Tax Act.

Mar 20, 2019, 11:07 AM ISTLinkage of PAN with Aadhaar is mandatory for filing IT return: SC

The court's direction came on an appeal filed by the Centre against a Delhi High Court order.

Feb 06, 2019, 15:49 PM ISTPre-filled I-T return from next year; refund process to be completed in just 1 day

The processing time at present for ITR is 63 days

Jan 17, 2019, 09:55 AM ISTDirect tax-GDP ratio of 5.98% during FY18 best in 10 years: FinMin

It was 5.57 percent in 2016-17 and 5.47 percent in 2015-16.

Jan 02, 2019, 15:45 PM ISTITR filing up 50% so far this year: CBDT chairman

The CBDT chief noted that so far the department has given 2.27 crore refunds, which is 50 per cent higher than last year.

Dec 04, 2018, 15:38 PM ISTITR filing: Last day to file income tax returns today

Filing ITR can be done both online and offline. Not filing ITR or late filing can attract a penalty up to Rs 10,000.

Aug 31, 2018, 08:01 AM ISTWhat is ITR-4? Who can file it and who can't

Here is all you need to know about ITR-4

May 16, 2018, 11:14 AM ISTIncome Tax Filing for FY 2017-18: List of various ITR forms and which return form to use

The last date for filing the ITRs is July 31.

Apr 12, 2018, 11:41 AM ISTITR filing FY 2017-18: Pay up to Rs 10,000 penalty for late filing this year

For individual taxpayers, the due date of filing income tax return for FY 2017-18 (AY 2018-19) is on July 31, 2018.

Apr 09, 2018, 11:11 AM ISTTaxpayers receiving pension from ex employers eligible for Rs 40,000 standard deduction

Rs 40,000 standard deduction for salaried employees and pensioners was introduced in lieu of the exemption in respect of transport and medical expenses.

Apr 06, 2018, 13:13 PM ISTLast day to file IT return today: Here’s what you need on your checklist

With the fiscal year closing on Saturday - March 31, 2018, various tax related matters have to be completed by the end of the day. This is the last day of the current fiscal year, and if you have not completed important tax-related tasks, now is the time to do it.

Mar 31, 2018, 10:55 AM ISTITR not filed for 2 years? Know how to file belated ITR, penalty, deadline and more

Income Tax Department has fixed March 31, 2018 as the last date to file tax returns for AY 2016-2017 and 2017-2018.

Mar 22, 2018, 07:40 AM ISTNumber of 'crorepatis' in assessment year 2015-16 grew 23.5%

In the assessment year (AY) 2014-15, the 'crorepati' individuals or those with gross income of over Rs 1 crore (Rs 10 million) were 48,417 with a cumulative income of Rs 2.05 lakh crore.

Dec 20, 2017, 16:20 PM ISTI-T dept to slap higher tax rate on fraudulently revised ITRs filed post demonetisation

The idea behind the CBDT directive is that the legal provision of filing a revised or belated ITR is not misused and black income is not shown as white in the aftermath of demonetisation by a taxpayer.

Nov 26, 2017, 15:02 PM ISTMobile apps to maximize savings for financially healthy household

Using Paytm mobile wallets, consumers can purchase gold online and store it in vaults free of charge.

Aug 19, 2017, 16:42 PM ISTWorried about PAN Migration while shifting to new residence? Here is all you need to know

The 10-digit alphanumeric PAN number allotted to a person is used to link all of his/her financial transactions particularly tax payments, income tax return, wealth tax return.

Aug 19, 2017, 16:07 PM ISTNo inconsistency in number of tax payers: CBDT

The statement by the tax department follows some doubting the numbers over different figures quoted at different points of time.

Aug 18, 2017, 19:36 PM IST