Demonetisation impact: Nine lakh accounts under Operation Clean Money 'doubtful'

Nearly half of the 18 lakh people under the I-T scanner for suspicious bank deposits post cash ban have been put in the 'doubtful' category, but action against them will follow only after the new tax amnesty scheme ends on March 31.

Feb 16, 2017, 17:27 PM IST

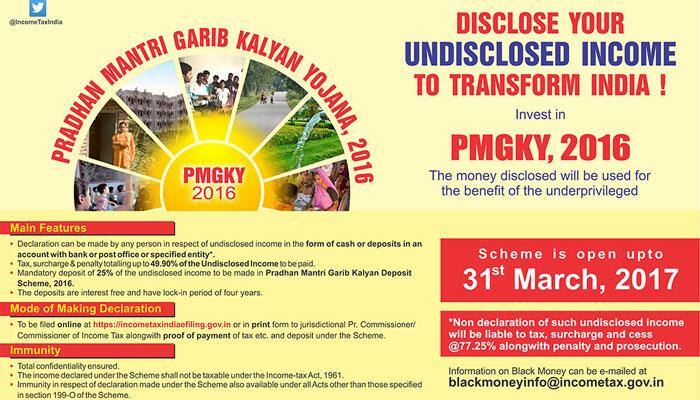

Foreign bank a/c, property, jewellery can't be disclosed under new Income Disclosure Scheme

Drawing a line for disclosure under the new tax evasion amnesty scheme, the government on Wednesday said only unaccounted domestic cash holding can be declared through it and not jewellery, stocks, immovable property or overseas accounts.

Jan 18, 2017, 18:24 PM ISTBlack money: Proof of tax paid, 4-year lock-in must to avail of new income disclosure scheme

Black money holders keen to avail of the new tax evasion amnesty scheme will have to first deposit 49.9 percent tax and park a quarter of their unaccounted cash in zero-interest deposit before being able to apply for it.

Dec 28, 2016, 15:34 PM IST