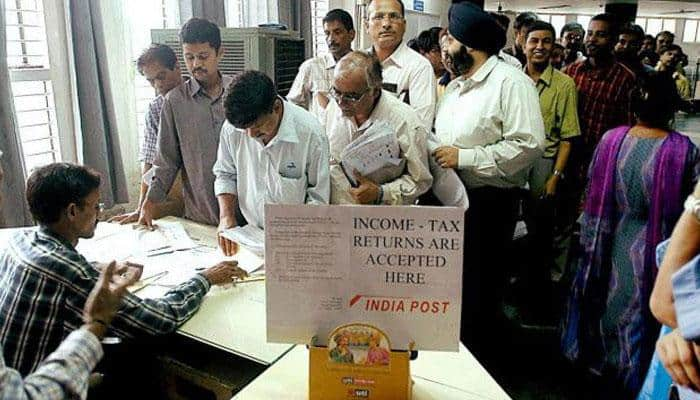

No inconsistency in number of tax payers: CBDT

The statement by the tax department follows some doubting the numbers over different figures quoted at different points of time.

Aug 18, 2017, 19:36 PM ISTHold back price hikes till GST roll out: Hasmukh Adhia tells India Inc

The government on Monday asked industry to hold back price increases till GST roll out from July 1, saying such hikes might later lead to inquiry of balance sheet by a specified authority.

May 22, 2017, 23:45 PM ISTHard cash being disclosed must exist on payment date: I-T dept

Weeks before the new tax amnesty scheme closes, the government has clarified that any hard cash being disclosed must exist at the time of making payments, but the same condition is not necessary for undisclosed income held in the form of deposits.

Mar 15, 2017, 12:19 PM ISTHold benami property? Get ready to face 7 years of rigorous imprisonment

The tax department today warned that those who undertake Benami transactions would invite Rigorous Imprisonment (RI) of up to 7 years and such violators would also stand to be charged under the normal I-T Act.

Mar 03, 2017, 12:17 PM ISTPAN a must for excise, service taxpayers for GST registration

The tax department has made it mandatory for central excise duty and service taxpayers to obtain a valid PAN number before they can be migrated to the new goods and services tax (GST) set-up.

Jan 08, 2017, 16:35 PM ISTDepositing Rs 2.5 lakh or above? Quoting PAN is mandatory, says CBDT

Quoting of PAN for cash deposits aggregating to Rs 2.5 lakh or more in bank accounts after the withdrawal of old 500 and 1000 rupees notes is mandatory, the tax department said Thursday.

Nov 17, 2016, 19:07 PM ISTState tax officers demand fair share in GST; to work on holiday

In a unique way of protest, about 2.36 lakh officers and employees working with commercial and sales tax departments of various states will work on Sunday to press for their demand of having a fair share in the administration of taxes under the proposed Goods and Services Tax (GST).

Nov 14, 2016, 19:14 PM ISTTax department issues SMS, emails to assessess on resolution scheme

With over Rs 5.16 lakh crore locked up in tax disputes before Commissioners, the revenue department has started sending emails and SMSes to assessees, asking them to avail of the ongoing one-time dispute scheme which will close by December end.

Oct 28, 2016, 20:15 PM ISTTax dept unearths Rs 56,378 crore undisclosed income in searches

The Income Tax department has unearthed undisclosed income of Rs 56,378 crore during search operations conducted over two years time and seized cash of about Rs 2,000 crore.

Oct 01, 2016, 18:43 PM ISTGST: Tax department unveils draft rules for registration, invoice and payments

In less than a week after the first meeting of the GST Council, the tax department came out with three draft rules and their formats relating to registration, invoice and payments which would be finalised by week-end.

Sep 26, 2016, 17:47 PM ISTBlackmoney disclosure:I-T dept not to question valuer's report

The valuation report from a registered valuer will not be questioned by the income tax department for disclosures made under the domestic black money compliance scheme, the CBDT clarified on Thursday.

Aug 18, 2016, 20:23 PM IST60,000 officers to be trained on GST; IT infra to be ready by March

As many as 60,000 revenue officials of central and state governments will be trained on GST laws and IT infrastructure framework to prepare them for rollout of the new indirect tax regime by April 2017.

Aug 04, 2016, 18:52 PM ISTGovt aims to make India ''tax paying, not tax evading'' society: Arun Jaitley

Union Finance Minister Arun Jaitley on Saturday said the government`s policy with regard to direct taxation is very clear, adding the ruling dispensation aims to gradually nudge the system to make India a tax paying society and not a tax evading society.

Jul 23, 2016, 18:18 PM ISTIncome Disclosure Scheme: Taxmen to seek info from suspected black money holders

Tax authorities plan to seek details from various entities against whom there is specific information of having undisclosed assets, as part of the domestic black money disclosure scheme.

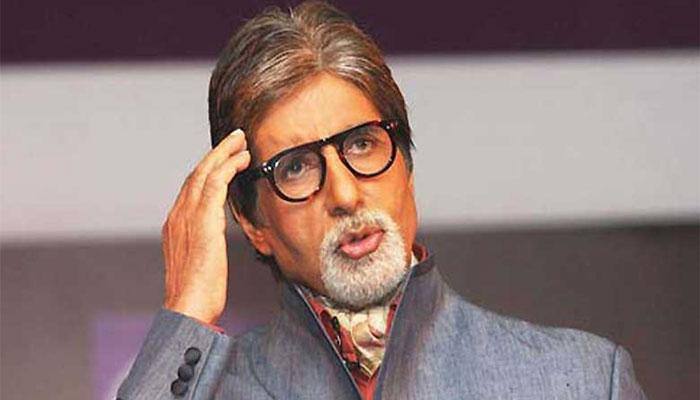

Jul 17, 2016, 12:32 PM ISTI'm a law abiding citizen: Amitabh Bachchan on tax evasion claims

On Friday, a news report shared the 73-year-old actor's "brush with the Income Tax Department right from 2009 and how his loans were paid off using offshore entities".

Apr 09, 2016, 10:15 AM ISTIndia in talks with Mauritius on tax treaty issues

India is discussing a whole host of issues with Mauritius including ways and means of ensuring that a tax treaty with the island nation is not misused, Akhilesh Ranjan, a joint secretary in the tax

Dec 03, 2015, 10:49 AM ISTGST can be implemented any time in 2016: CBEC

Assuring that the revenue neutral rate would not exceed 20 percent, Krishnan said a committee is already working on the Goods and Services Tax (GST) rate structure and is expected to submit its report very shortly.

Oct 08, 2015, 20:52 PM IST

Tax department's cash detection ability being strengthened: Arun Jaitley

Tax department's ability to detect large cash transactions is being strengthened to check the menace of black money as bulk of it remains within India, Finance Minister Arun Jaitley said on Sunday.

Oct 04, 2015, 15:26 PM ISTBad elements in tax dept to be dealt with: Revenue secy

Promising just and fair decision in all tax matters, the new Revenue Secretary Hasmukh Adhia today said "bad elements" in the tax department will be identified and "taken care of" so that they don't spoil the investment climate.

Sep 01, 2015, 15:30 PM ISTShah panel holds meeting with Tax Dept

The high-level Justice A P Shah panel, set up to look into the levy of MAT on FIIs today held consultations with officials of the tax department.

Jul 07, 2015, 17:54 PM IST