Panel discussion on non-cooperation movement to curb corruption

The Nagpur bench of Bombay High Court expressed serious concern over the growing number of corruption cases and called on the citizens to launch a non-cooperation movement if the government fails t

Feb 03, 2016, 19:57 PM ISTStolen data issue impacts tax cooperation with India: Swiss government

Switzerland's tax cooperation with India is being negatively impacted over the "contentious" issue of sharing information based on illegally obtained data, according to the Swiss government.

Feb 03, 2016, 19:36 PM IST

Mauritius to begin automatic tax info exchange from September 2018

Mauritius will start automatic exchange of tax information with other nations only from September 2018, as it has postponed by a year implementation of global common reporting standard on tax matters.

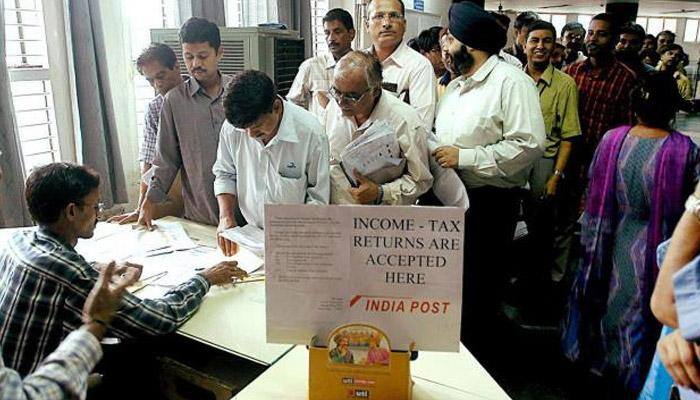

Jan 31, 2016, 22:13 PM ISTOver 11 lakh file tax returns under special drive by IT department

Over 11 lakh taxpayers have filed their IT returns for Assessment Year 2014-15 after the department tracked them under a special drive to identify those who have not filed their returns despite having an obligation to do so, according to official data.

Jan 31, 2016, 21:33 PM ISTInsurance industry seeks hike in tax exemption limit

Government should raise tax exemption limit for health insurance and introduce fiscal measures to help increase its penetration, say industry officials.

Jan 31, 2016, 20:52 PM ISTBlack money: Significant progress in tax cooperation with India, says Swiss govt

India and Switzerland have been working closely on mutual administrative assistance on tax matters and both sides have expressed their willingness to step up the cooperation.

Jan 31, 2016, 20:07 PM ISTRetrospective Tax is thing of the past, will never be opened again: PM Narendra Modi

Addressing the business leaders of France and India here in presence of French President Francois Hollande, Modi said his government wants to ensure that foreign investors are clear about tax systems that will prevail in India over the next 15 years.

Jan 24, 2016, 20:05 PM ISTTax payers can now e-verify ITRs using bank, demat a/c details

Currently an Income-Tax Return or ITR can be e-verified by using internet banking, email or an Aadhaar number-generated One Time Password (OTP).

Jan 22, 2016, 19:21 PM IST

Tax refund totals Rs 65,000 cr so far this fiscal: FinMin

The Income Tax department has issued a record Rs 65,000 crore worth refunds so far this fiscal, Finance Ministry said Saturday.

Jan 16, 2016, 16:05 PM ISTGovt may lower long-term capital gain tax for unlisted companies

Government Saturday hinted at lowering the long-term capital gain tax on investments made in unlisted firms, particularly startups, in the Budget for the next financial year, to bring them closer to the levels prevalent for the listed companies.

Jan 16, 2016, 15:56 PM ISTAntim Baazi: Analysis Of PSU Banking Sector

Analysis Of PSU Banking Sector

Dec 17, 2015, 16:31 PM ISTFinMin raises monetary limit for filing appeals in tax cases

Seeking to reduce tax litigation by about 50 percent, the Finance Ministry today raised the monetary limit for filing appeals to Rs 10 lakh in appellate tribunal, and Rs 20 lakh in High Courts.

Dec 15, 2015, 23:28 PM ISTI-T Dept simplifies online rectification of TDS in ITR

Aimed at making life easier for tax payers, the I-T department on Thursday said it simplified the process of online rectification of incorrect details of tax deducted at source (TDS) filed in the income tax return (ITR).

Dec 10, 2015, 17:59 PM IST

'Target non-TDS income group, cash economy to widen tax base'

To widen the tax base, a Parliamentary panel on Thursday asked the government to use its resources with "strict vigil" over non-TDS income group and which are lying above Rs 5 lakh annual income bracket.

Dec 03, 2015, 19:13 PM ISTNo proposal to levy 'environmental charge': Govt

Seeking to boost the clean India initiative, the government has started imposing a 'Swachh Bharat cess' of 0.5 per cent on all services liable for service tax.

Dec 02, 2015, 21:11 PM ISTGood news for taxpayers! Income Tax grievances to be addressed in 2 months

Taxpayers facing "high-pitched" assessments or unfair scrutiny by the Income Tax Department can now attempt to get their grievances redressed in a short time before undertaking the arduous litigation route of courts or other appellate mechanisms.

Nov 17, 2015, 17:43 PM ISTSwachh Bharat cess to be levied on portion of taxable service

Finance Ministry Thursday said that service tax on restaurant bills will go up from 5.6 percent to 5.8 percent following the levy of 0.5 percent Swachh Bharat cess on all taxable services from November 15.

Nov 12, 2015, 22:00 PM ISTGovt extends tenure of Lahiri Panel by 1 year

Government has extended by one year the tenure of a high level committee set up under former Chief Economic Advisor Ashok Lahiri to suggest steps to sort out taxation problem being faced by the trade and industry.

Nov 12, 2015, 16:12 PM ISTEfforts to roll out GST from next fiscal: Jayant Sinha

Regretting at "low" tax payment, the Minister said the Narendra Modi-led government at the Centre, which has a mandate to provide corruption free and transparent regime, had toughened laws to prevent tax evasion and curb black money.

Nov 07, 2015, 20:38 PM IST