CBDT issues certificates of appreciation to nearly 3.74 lakh tax payers

The total number of certificates issued by CBDT now stands at approximately 23 lakh.

Feb 08, 2017, 13:18 PM ISTTax officers to maintain digital records of summons, notices

Reducing discretionary powers of taxmen, the income tax department has asked its field officers to maintain digital records of summons, notices and special audit ordered by them.

Feb 08, 2017, 12:50 PM ISTHSBC, ICIJ list: I-T dept detects Rs 16,200 crore black money

Over Rs 16,200 crore in black money has been detected by the government after investigations on global leaks about Indians stashing funds abroad, Parliament was informed Tuesday.

Feb 07, 2017, 18:52 PM ISTCBDT signs 4 more advance pricing pacts with tax payers

The CBDT expects more APAs to be concluded and signed before the end of the current fiscal.

Feb 07, 2017, 13:16 PM IST

Arun Jaitley defends surcharge levy, says rich must pay more

Finance Minister Arun Jaitley Friday justified levy of 10 percent surcharge on rich saying the resources in a largely non-tax compliant society will have to come from the more affluent.

Feb 03, 2017, 22:46 PM ISTI-T department to question 18 lakh tax-payers, scan deposits of over Rs 5 lakh: Hasmukh Adhia

Hasmukh Adhia. Watch the full segment for more details.

Feb 02, 2017, 23:59 PM ISTCongress government saw traders as 'tax evaders': BJP

The BJP on Thursday attacked the Congress for opposing the Union Budget and suspecting traders to be "tax evaders" and said the Narendra Modi-led government at the Centre respects the traders.

Feb 02, 2017, 18:54 PM ISTI-T dept asks taxpayers to e-verify deposits post demonetisation

As the Income Tax Department uses Big Data to catch evaders, it is asking taxpayers to verify online the deposits they made in their accounts post demonetisation and respond to queries of any mismatch.

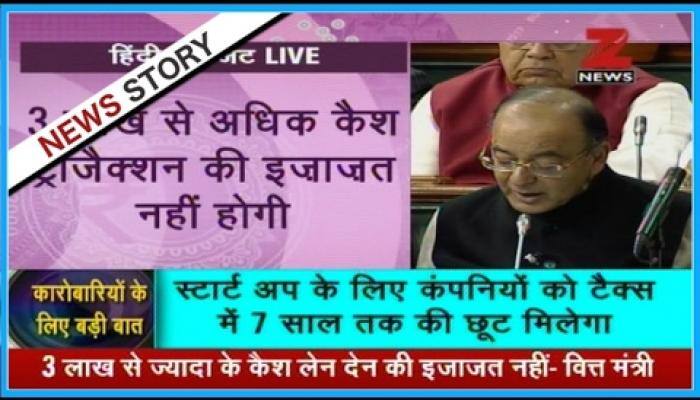

Feb 02, 2017, 16:09 PM ISTBudget 2017: 3-year tax holiday for start-ups in first 7 years of existence

Relief in tax for startups for seven years. Watch this special segment and get to know more here.

Feb 01, 2017, 15:59 PM ISTGAAR to be implemented from April 2017

GAAR to be implemented from April 2017. Watch this special segment and get to know more here.

Jan 27, 2017, 23:21 PM ISTBudget 2017: Arun Jaitley may cut taxes to spur growth; likely to raise income tax exemption slabs

As Finance Minister Arun Jaitley presents the Union Budget 2017 next week, he will be faced with the challenge of lowering tax in order to spur growth following the slump in demand after the demonetisation move.

Jan 27, 2017, 20:15 PM ISTGAAR from April 1, 2017; to be invoked in fair, rational manner: CBDT

GAAR, it said, will come into force from April 1 and can be invoked only through a two-stage process involving a nod at the level of principal commissioner of income tax and a panel headed by a high court judge.

Jan 27, 2017, 19:31 PM ISTGAAR to be effective from April 1, 2017: CBDT

Addressing investors' concerns ahead of GAAR implementation from April 1, the tax department today said it will not interplay with their right to choose a method of transaction and won't apply if routing of funds through a jurisdiction is "based on non-tax commercial considerations".

Jan 27, 2017, 18:13 PM ISTCash deposits above Rs 10 lakh in bank account to come under I-T lens

The tax department has asked banks to report deposits in any account aggregating Rs 10 lakh in a year, as well as cash payments of Rs 1 lakh or more on credit card bills.

Jan 19, 2017, 16:09 PM IST

GST: Consensus on dual control reached, says Arun Jaitley

In a major boost for the government, Finance Minister Arun Jaitley on Monday informed that a consensus between the state and the centre has been reached on dual control of the goods and services tax (GST).

Jan 16, 2017, 18:18 PM ISTPAN card must for all bank account holders by February 28

In yet another to fight against black money and tax evasion, the government has notified that all individuals having bank accounts will have to update their PAN or Form-60 if PAN not available by February 28, 2017.

Jan 08, 2017, 17:34 PM ISTGovernment extends tax dispute resolution scheme by one month

The government on Friday extended the tax dispute resolution scheme by one month to January 31, 2017.

Dec 30, 2016, 12:18 PM ISTNo cash payment in demonetised notes for PMKGY after Dec 30: IT official

No one will be able to pay tax, surcharge, penalty and deposits under the Pradhan Mantri Garib Kalyan Yojana (PMGKY) scheme in demonetised notes after December 30, even though the scheme will continue till March 31, 2017, an Income Tax official said on Wednesday.

Dec 28, 2016, 22:54 PM ISTPost raids, black money to attract over 137% in tax, penalty

Black money holders will have to bear taxes and penalties amounting to as high as 137 percent if they do not admit to or fail to explain the source of undisclosed income after being raided, the income tax department today said.

Dec 27, 2016, 00:03 AM ISTIT Department puts name of tax defaulters on their website

IT Department puts name of tax defaulters on their website . Watch the full segment for more details.

Dec 23, 2016, 22:52 PM IST