Decoding The Budget: All You Need To Know About Indirect Tax

There are two main types of taxes: direct taxation and indirect taxation

Jan 16, 2024, 18:33 PM ISTDecoding Budget Terms: What Is Indirect Tax? Definition, Types, And More - Check Here

Indirect tax is a kind of tax that can move from one place to another.

Jan 13, 2024, 18:31 PM ISTGST Collections For August At Rs 1,59,069 Crore, 3.6% Lower Than July

The government has settled Rs 37,581 crore to CGST and Rs 31,408 crore to SGST from IGST. The total revenue of Centre and the states in August 2023 after regular settlement was Rs 65,909 crore for CGST and Rs 67,202 crore for SGST. The revenues for August 2023 are 11 per cent higher than the GST revenues in the same month last year.

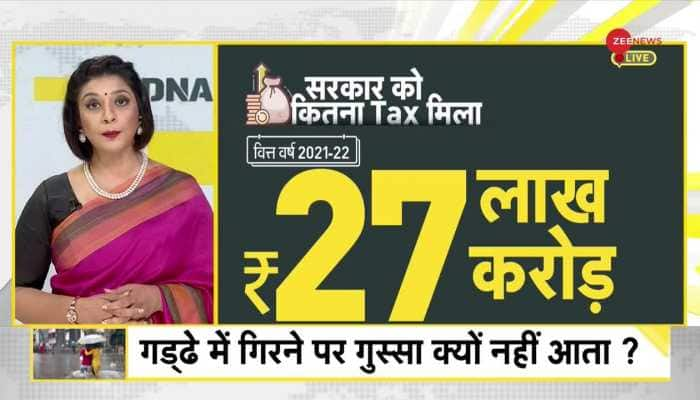

Sep 01, 2023, 19:13 PM ISTDNA: What facilities government has provided in lieu of taxes?

In the financial year 2021-22, the Government of India had received Rs 27 lakh crore as tax. Of these, Rs 14 lakh crore was received by the government in the form of direct tax and Rs 13 lakh crore in the form of indirect tax. But what facilities government has provided in return?

Jul 07, 2022, 01:42 AM ISTNumber of e-filing of ITR increase 18.65% in AY 2018-19

The number of e-Returns submitted for Assessment Year 2018-19 is 6,49,39,586 as against 5,47,30,304 e-Returns filed for the Assessment Year 2017-18.

Jun 25, 2019, 14:17 PM ISTI-T dept issued Rs 64,700-cr refund between Apr 1-Jun 18, 2019: Sitharaman

In a written reply to a question in the Lok Sabha, she said over 6.49 crore electronic returns were submitted for assessment year 2018-19 (financial year 2017-18), up 18.65 per cent from over 5.47 crore in assessment year 2017-18.

Jun 24, 2019, 14:54 PM ISTEconomic Survey 2017-18: 5 new facts on Indian economy

The Narendra Modi government on Monday tabled in Parliament, the Economic Survey 2018, which has pegged 2018-19 GDP growth at 7-7.5 per cent. The Economic Survey further raised concerns on high oil prices.

Jan 29, 2018, 13:37 PM ISTAfter demonetisation and GST, Modi govt sets sight on new Direct Tax law

The move, which is aimed to make direct taxes - income and corporate - simple, comes ahead of BJP-led government's last full Budget.

Nov 23, 2017, 10:05 AM ISTGST impact: Customers enjoy upto 60% discount as retailers get busy clearing stocks

With less than 10 days to go for the biggest indirect tax reform to take effect, retailers are rushing to clear their stocks by offering huge discounts ranging from around 30 percent to 60 percent.

Jun 22, 2017, 13:39 PM ISTGST inches closer to July 1 rollout: Things that you must know

Touted as the biggest indirect tax reform since independence, GST would subsume central excise, service tax and other local levies.

Apr 03, 2017, 10:20 AM ISTIndirect tax revenue grows 22% in Apr-Feb; direct tax up 10.7%

The government's revenue collection from indirect tax during April-February grew by an impressive 22.2 percent while that of direct tax rose by 10.7 percent.

Mar 10, 2017, 13:53 PM IST

Tata Motors, Kingfisher Airlines owe over Rs 1,000 crore each in indirect tax

Tata Motors and Kingfisher Airlines are among the four companies that owe over Rs 1,000 crore in indirect taxes to the exchequer, Parliament was informed on Friday.

Nov 25, 2016, 15:20 PM ISTCBDT tells officers to submit data of appeals disposed of every month

To fast-track disposal of tax cases, CBDT has started reviewing performance of its officers and asked commissioners to submit data on number of appeals they have disposed of every month against the given target.

Oct 17, 2016, 14:33 PM ISTIndirect tax collection jumps 26% in April-September, direct tax 9%

Government's revenue collection in April to September -- the first half of the current fiscal -- saw indirect tax-mop up growing at an impressive 26 percent while that of direct tax came in at a tepid 9 percent.

Oct 10, 2016, 22:44 PM ISTDirect tax collections till September grow 9% to Rs 3.27 lakh crore

Direct tax collections during the six months ended September grew about 9 percent to Rs 3.27 lakh crore, buoyed mainly by personal income tax mop-up.

Oct 10, 2016, 21:34 PM ISTGST Council to hold its first meeting today

The council will decide on long pending issues of threshold limit for applicability of the tax as well as the limit for dual control between Centre and states. Union Finance Minister Arun Jaitley will chair the meeting.

Sep 22, 2016, 08:39 AM ISTGovernment's tax kitty swells to Rs 4.3 lakh crore in April-July

Reflecting an upturn in economic activity, government's revenue collection showed an impressive growth in April-July period of this fiscal, with total direct and indirect tax mop-up rising to Rs 4.3 lakh crore.

Aug 09, 2016, 22:53 PM ISTGST: 1% additional tax dropped; states to get full compensation for first 5 years

The Cabinet on Thursday cleared changes in the GST Constitutional Amendment Bill, dropping 1 percent manufacturing tax and providing guarantee to compensate states for any revenue loss in the first five years of rollout of the proposed indirect tax regime.

Jul 28, 2016, 12:26 PM ISTBreakthrough: Cabinet approves changes to GST Bill, states to get full compensation for first 5 years

The Union Cabinet on Wednesday approved changes in the GST Constitutional Amendment Bill providing for full compensation to states for first five years of roll out of the new indirect tax regime.

Jul 27, 2016, 20:22 PM ISTFinance Ministry releases draft of model GST Bill

Finance Ministry on Tuesday released the draft of model GST Bill.

Jun 14, 2016, 16:06 PM IST