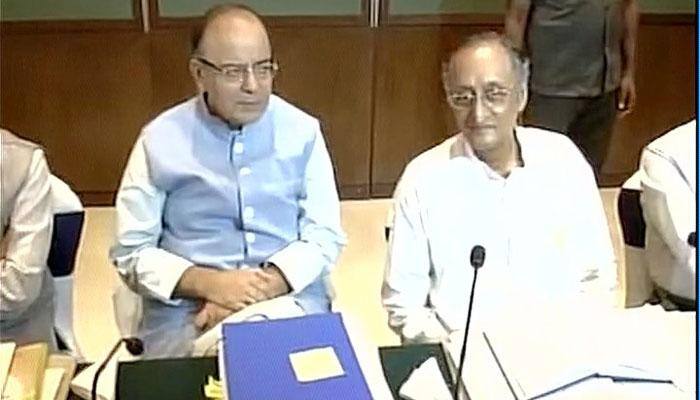

GST deadlock: Crucial meeting of state FMs with Arun Jaitley begins, breakthrough likely

The meeting on June 14 and 15 will discuss the model GST law, which will be adopted by the Centre and all states.

Jun 14, 2016, 12:37 PM ISTGovernment unearths indirect tax evasion of Rs 50,000 crore in 2 years

As much as Rs 50,000 crore of indirect tax evasion and another Rs 21,000 crore of undisclosed income has been unearthed by the government in the last two years.

May 10, 2016, 14:18 PM ISTSpurt in indirect tax mop up to help govt meet FY16 target

After two successive years of revising downward the tax revenue target, fiscal 2015-16 which ends on March 31 is likely to see tax revenue target of Rs 14.49 lakh crore being met.

Feb 10, 2016, 13:27 PM IST

Indirect tax mop-up paces up, grows 36% during Apr-Oct 2015

In October 2015, indirect tax revenue collections rose 36.8 percent from a year ago.

Nov 10, 2015, 00:12 AM IST36.5% rise in indirect tax receipts a huge positive: Jaitley

The 36.5 percent rise in indirect tax collections "looks bigger because of certain additional revenue measures which we took since November last year", Jaitley said.

Nov 04, 2015, 15:37 PM ISTReport on uniform GST rate by month end

The government panel set up to suggest a uniform rate of indirect tax under the GST regime will submit its report by this month-end and the roll out of the reform measure is possible any time next fiscal, a senior CBEC official said Wednesday.

Sep 16, 2015, 14:51 PM ISTPresent indirect taxation system complete mess: Arun Jaitley

Union Finance Minister Arun Jaitley Thursday said the present indirect taxation system is in a "complete mess" and sought support of political parties and state governments for implementation of Goods and Service Tax reform.

Sep 11, 2015, 00:02 AM ISTVery optimistic on passage of GST, other bills: Sitharaman

Government on Friday said it is 'very optimistic' of getting the much stalled reform bills like GST passed in Parliament despite strident disruptions by the Congress seen in the just ended Monsoon Session.

Aug 14, 2015, 17:28 PM ISTGovernment introduces GST Bill in Rajya Sabha amid ruckus

Amid ruckus by opposition members in the Rajya Sabha, Finance Minister Arun Jaitley on Tuesday introduced a constitutional amendment bill to enable implementation of goods and services tax (GST) in the country.

Aug 11, 2015, 16:10 PM ISTIndirect tax revenue surges 37% to Rs 2.1 lakh crore in Apr-Jul

Indirect tax revenue jumped over 37 percent to over Rs 2.1 lakh crore during April-July period of current fiscal, on the back of higher excise collections.

Aug 11, 2015, 16:01 PM ISTGST Bill: 10 Key facts you should know

GST is expected to streamline the taxation system and cut down multiplicity of compliance and cascading effect of taxes.

Aug 11, 2015, 09:31 AM ISTGovt clears GST amendments, states to be compensated for 5 years

The Cabinet decided that the modalities for levy of 1 percent tax over and above the GST rate by states as well as the 'band' rate would be finalised while framing the rules, sources said.

Jul 29, 2015, 20:55 PM ISTCabinet approves amendments to GST Bill

The Union Cabinet on Wednesday approved amendments as proposed by Rajya Sabha Select Panel on GST Constitution Amendment Bill.

Jul 29, 2015, 20:27 PM ISTMicrosoft, TCS, Infosys and others bid for building GST Network

Five IT companies, including Microsoft, TCS and Infosys, have bid for building the GST network across the country for smooth roll out of the new indirect tax regime.

Jul 17, 2015, 19:25 PM ISTIndirect tax collections pace up, grow 37.5% in April-June

IIP data showed that the growth in factory output in the first two months of the fiscal was 3 percent as against 4.6 percent in April-May of 2014-15.

Jul 11, 2015, 10:58 AM ISTIndian businesses turn sceptical on PM Modi's landmark tax reform

Companies are equally worried that the reform does not extend to real estate, one of the biggest revenue generators for the states, leaving them still subject to state taxes on plant and property, possibly including machinery.

Jul 02, 2015, 09:27 AM ISTSpurt in indirect taxes indicates economic recovery: CEA

The Finance Ministry Thursday said the spurt in indirect tax collections this fiscal was an indication of economic recovery though there was some need for caution as these were only early indications.

Jun 11, 2015, 20:04 PM ISTIndirect tax collections up 46.2% in April

Led by over two-fold surge in excise duty collections, indirect tax revenue jumped 46.2 percent to Rs 47,747 crore in April this year compared to the same month last year.

May 12, 2015, 20:31 PM ISTGST Bill: 10 key facts you should know

The GST subsumes various central indirect taxes including the Central Excise Duty, Countervailing Duty, Service Tax, etc. It also subsumes state value added tax, octroi and entry tax, luxury tax, etc.

May 06, 2015, 18:28 PM ISTGST: State FMs to meet on May 7 in Kerala

A consensus would be built among states for implementation of the Goods and Services Tax by April 2016 as there is no "obstinate opposition" from any state, said K M Mani, the newly selected Chairman of the Empowered Committee of State Finance Ministers.

Apr 10, 2015, 18:05 PM IST